- 您现在的位置:买卖IC网 > Sheet目录242 > PFE1100-12-054NA (Power-One)FRONT END AC/DC 1100W W/ PFC

PFE1100-12-054NA White Paper Issue 6

Expected Server Growth Through 2010.

This power supply is primarily aimed at the server industry, so it makes sense to take a snapshot of that

industry to gauge the demand.

The server industry took a distinctive downward trend throughout 2009 as OEM’s and IT customers reduced

budgets quarter by quarter to reduce costs. Roadmaps were halted, major programs postponed, and for a

while innovation and new designs either slowed down or stopped. Industry experts at IDC and Gartner do

expect 2010 to herald the return to a recovery throughout 2010 and into 2011, particularly in the X86 space,

where demand for blade and volume servers is expected to accelerate, as infrastructures consolidate and to

satisfy a pent up demand in the corporate space taking hold.

The ?nancial markets are expecting growth in volume servers and blades from 3Q10 with positive growth

around 2Q10. Mid-to-high range servers will have to wait until 1Q11 to see any real growth.

It is not all good news, although growth is expected we are coming out of a deep and extended recession.

The industry has changed, and that change is set to remain for some time; the bubble truly burst. EMEA is

expected to recover slower than the U.S. with IDC predictions of 2.4% increases for 2010 in Europe compared

to the 27% decline throughout 2009. Due to the downward trend, customers of mid-to-high end servers

began considering x86 solutions and server virtualization for increasing workloads across fewer servers.

In reality, industry is preparing for a four-year recovery to reverse the decline seen throughout 2009, and

maybe even six years to see the peaks of 2007 return.

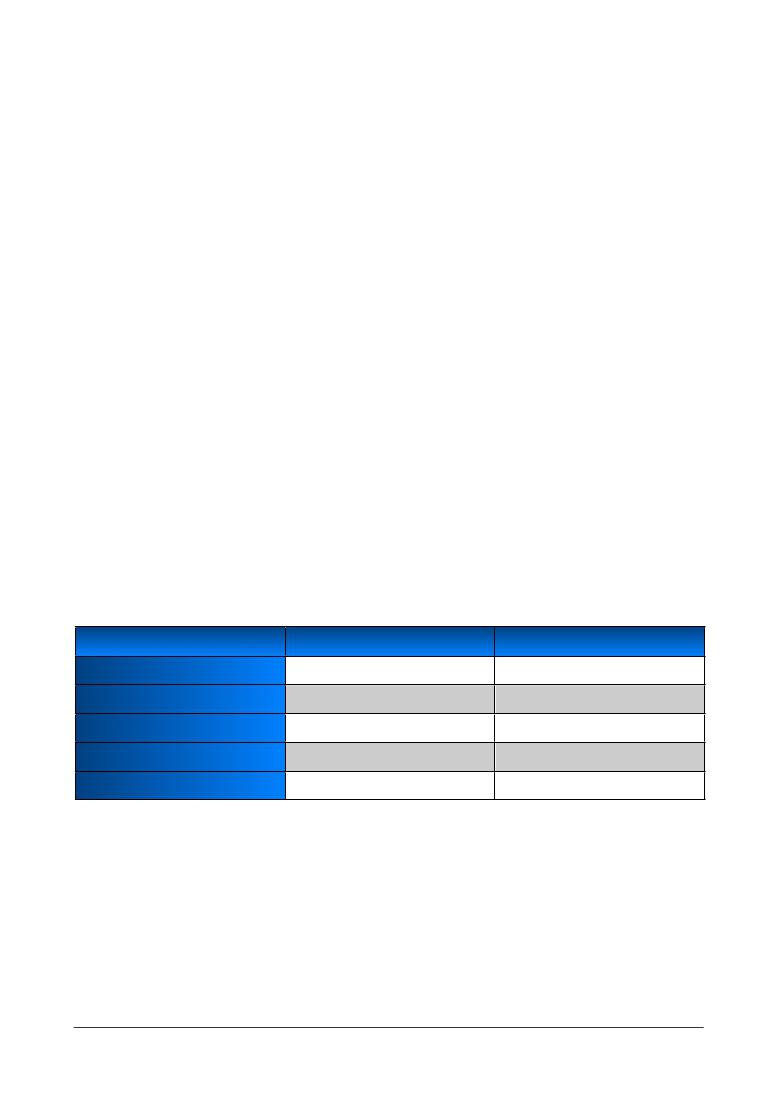

Server sales dropped six quarters in a row. Table 1 below shows the 4Q09 revenues from the main OEM’s.

Table 1. 4Q09 OEM sales revenues.

Dell

HP

Sun/Oracle

IBM

Fujitsu

P e r i t u s P o w e r !

OEM

REVENUE

$337.5 million

$1.4 billion

$387 million

$1.29 billion

$201 million

4

SALES DOWN %

-16%

-9.6%

-18.6%

-10.1%

-4.7%

P o w e r - O n e I N C . 1 U P F E 11 0 0 - 1 2 - 0 5 4 N A P l a t i n u m

发布紧急采购,3分钟左右您将得到回复。

相关PDF资料

PFE1100-12-054ND

FRONT END 1100W 12V HI EFFICINCY

PFE500S-28/T

PWR SUP AC/DC 85-265VAC 28V

PFE700S-48

PWR SUP AC-DC 85-265VAC 51V 14A

PFE850-12-054RA

FRONT END 850W 12V HI EFFICIENCY

PGB1040805NR

SUPPRESSOR ESD 24VDC 0805 SMD

PGB2010402KRHF

SUPPRESSOR ESD 12VDC 0402 SMD

PHW603616

BOX FIBER 63.5X36.5X18.1" GREY

PI-1902

BOX ABS 1.26" X 1.97" X 3.54"GRY

相关代理商/技术参数

PFE1100-12-054ND

功能描述:FRONT END 1100W 12V HI EFFICINCY RoHS:是 类别:电源 - 外部/内部(非板载) >> AC DC 转换器 系列:* 产品培训模块:MP Modular-Configurable AC-DC Power Supply 特色产品:Configurable Power Supplies 标准包装:1 系列:MP

PFE1100-12-054RA

功能描述:FRONT END 1100W 12V HI EFFICINCY RoHS:是 类别:电源 - 外部/内部(非板载) >> AC DC 转换器 系列:* 产品培训模块:MP Modular-Configurable AC-DC Power Supply 特色产品:Configurable Power Supplies 标准包装:1 系列:MP

PFE1100-12-054RD

制造商:Power-One 功能描述:- Trays 制造商:Power-One 功能描述:Power One PFE1100-12-054RD DC to DC

PFE-12

制造商:FAIRFORD ELECTRONICS 功能描述:SOFTSTARTER PFE-12 22A 制造商:FAIRFORD ELECTRONICS 功能描述:SOFTSTARTER, PFE-12 22A 制造商:FAIRFORD ELECTRONICS 功能描述:SOFTSTARTER, PFE-12 22A; Supply Voltage Range:230V AC to 460V AC; No. of Phases:Three; Power Rating:15hp; Current Rating:22A; Operating Temperature Min:0C; Operating Temperature Max:40C; Approval Bodies:IEC; Control Voltage DC ;RoHS Compliant: NA

PFE12HSX-U

功能描述:线性和开关式电源 240W 12V 36A RoHS:否 制造商:TDK-Lambda 产品:Switching Supplies 开放式框架/封闭式:Enclosed 输出功率额定值:800 W 输入电压:85 VAC to 265 VAC 输出端数量:1 输出电压(通道 1):20 V 输出电流(通道 1):40 A 商用/医用: 输出电压(通道 2): 输出电流(通道 2): 安装风格:Rack 长度: 宽度: 高度:

PFE12HSX-U1

功能描述:线性和开关式电源 240W 12V 36A RoHS:否 制造商:TDK-Lambda 产品:Switching Supplies 开放式框架/封闭式:Enclosed 输出功率额定值:800 W 输入电压:85 VAC to 265 VAC 输出端数量:1 输出电压(通道 1):20 V 输出电流(通道 1):40 A 商用/医用: 输出电压(通道 2): 输出电流(通道 2): 安装风格:Rack 长度: 宽度: 高度:

PFE12HSX-U-P

功能描述:线性和开关式电源 240W 12V W/COVER RoHS:否 制造商:TDK-Lambda 产品:Switching Supplies 开放式框架/封闭式:Enclosed 输出功率额定值:800 W 输入电压:85 VAC to 265 VAC 输出端数量:1 输出电压(通道 1):20 V 输出电流(通道 1):40 A 商用/医用: 输出电压(通道 2): 输出电流(通道 2): 安装风格:Rack 长度: 宽度: 高度:

PFE1300-48-054NA

功能描述:POWER SUPPLY FRONT END 1.3KW FAN 制造商:bel power solutions 系列:PFE1300 零件状态:有效 类型:前端 输出数:1 电压 - 输入:90 ~ 264 VAC 电压 - 输出 1:48V 电压 - 输出 2:- 电压 - 输出 3:- 电压 - 输出 4:- 电流 - 输出(最大值):26.8A 功率(W):1300W 应用:ITE(商业) 电压 - 隔离:4.242kV(4242V) 效率:94% 工作温度:0°C ~ 45°C 特性:可调输出,热插拔,I2C? 接口,负载均分,PFC,PMBus?,远程开/关,遥测,待机输出 安装类型:机架安装 大小/尺寸:12.66" 长 x 2.15" 宽 x 1.57" 高(321.5mm x 54.5mm x 40.0mm) 所需最小负载:- 认可:CB,cCSAus,CE,NEMKO 功率(W) - 最大值:1286W 标准包装:30